Posted on

March 2, 2023

by

Sarah Graham

March 01, 2023 | CREB

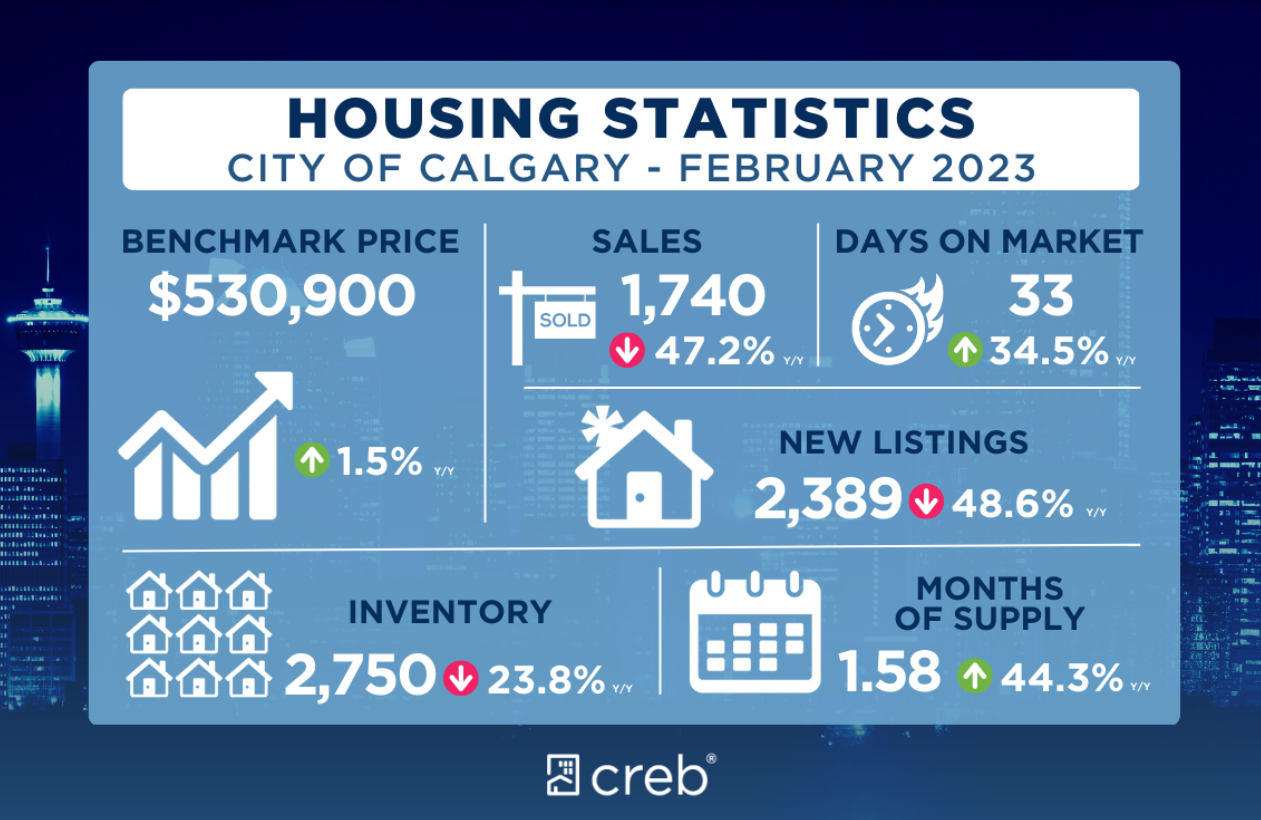

Lowest February inventory since 2006

Consistent with typical seasonal behavior sales, new listings and inventory levels all trended up compared to last month. However, with 1,740 sales and 2,389 new listings, inventory levels improved only slightly over the last month and remained amongst the lowest February levels seen since 2006.

“While higher lending rates are impacting sales activity as expected, we are seeing a stronger pullback in new listings, keeping supply levels low and supporting some stronger-than-expected monthly price gains,” said CREB® Chief Economist Ann-Marie Lurie. “Prices are still below the May 2022 peak and it is still early in the year. However, if we do not see a shift in supply, we could see further upward pressure on prices over the near term.”

Both sales and new listings declined over last year’s record high for the month. While sales activity remained stronger than long-term trends and levels reported throughout the 2015 to 2020 period, new listings fell below long-term trends.

With a sales-to-new-listings ratio of 73 per cent and a months of supply of under two months, the market has struggled to move into balanced territory causing further upward pressure on home prices. The unadjusted benchmark price increased by nearly two per cent over January levels and last year’s prices.

Detached

Both sales and new listings reported significant year-over-year declines over last year’s record high. While the seasonal monthly gain did see inventories move up over the last two months, levels are still amongst the lowest seen in February, and the months of supply fell below two months.

Further tightening conditions did cause the unadjusted benchmark prices to rise over last month’s levels, but at a price of $635,900, it is still below the peak reported in May 2022. While supply continues to remain a challenge relative to demand for lower-priced homes, we are seeing conditions shift into balanced territory for homes priced above $700,000.

Semi-Detached

Like the detached sector despite the seasonal monthly gain, both sales and new listings fell from last year’s record high. While inventories are starting to rise over the levels seen in the past few months, they remain amongst the lowest levels reported for February. The relatively low inventory levels caused the months of supply to fall below two months in February, while it is still higher than last year’s ultra-low levels, conditions continue to favour the seller.

The unadjusted benchmark price reached $568,100 in February, nearly two per cent higher than last month and a three per cent gain over last February. Persistently tight market conditions contributed to the monthly unadjusted gain in the benchmark price. However, like detached properties prices remain below the May 2022 peak.

Row

Conditions remained exceptionally tight in February with only one month of supply and a sales-to-new listings ratio of 87 percent. While row sales have eased over record levels, they have remained relatively strong for February as demand shifts toward the affordable product in the market.

The persistently tight conditions caused further upward pressure on prices. In February, the unadjusted benchmark price reached $369,700, a monthly gain of over two per cent and a year-over-year gain of nine per cent. Unlike the other sectors, prices have reached a new high this month.

Apartment Condominium

Sales for apartment condominiums did not see the same pace of decline as other property types in February partly due to the level of new listings coming onto the market. Persistently strong sales compared to listings have caused February inventory levels to remain relatively low compared to levels seen over the past eight years and the months of supply once again dropped below two months.

The tight market condition contributed to the upward pressure on prices. In February, the unadjusted apartment benchmark price reached $286,000, nearly three per cent higher than last month and over 11 per cent higher than last February. While prices are still higher than the levels reported last year, they remain nearly seven per cent below the peak levels reported back in 2014.

Source: CREB